IC Markets Review 2025 – Is This the Right Broker for You?

IC Markets is one of the most well-known brokers worldwide. But is it the right choice for you? In this detailed review, we’ll break down everything you need to know. From spreads and platforms to fees and security, you’ll get a complete picture. So, if you’re looking for an in-depth, unbiased IC Markets review, you’ve come to the right place!

Visit IC MarketsIC Markets: A Quick Overview

IC Markets is a globally recognized broker that stands out for its ultra-tight spreads, low commissions, and high-speed execution. Because it offers multiple trading platforms, it caters to both beginners and advanced traders. But is it the best option for you? Let’s break down its key features before diving into the details.

| Feature | Details |

|---|---|

| Regulation | ASIC, CySEC, FSA (Seychelles) |

| Platforms | MetaTrader 4, MetaTrader 5, cTrader, TradingView |

| Spreads | Starting from 0.0 pips (Raw Spread Accounts) |

| Leverage | Up to 1:500 (varies by region) |

| Minimum Deposit | $200 |

| Commission | $3.50 per lot (Raw Accounts) |

| Assets | Forex, Indices, Commodities, Stocks, Crypto |

- Ultra-low spreads, starting from 0.0 pips, help reduce trading costs.

- Fast execution ensures minimal slippage, which improves trade accuracy.

- Multiple platforms, including TradingView, offer flexibility for different traders.

- Because it is regulated in multiple jurisdictions, trader security is enhanced.

- Leverage up to 1:500 allows for greater position sizes, but risk management is key.

IC Markets: Pros & Cons

Like any broker, IC Markets has strengths and weaknesses. While it offers low spreads, fast execution, and strong regulation, there are also a few drawbacks to consider. Below is a summary of the pros and cons to help you decide.

Pros

- Ultra-low spreads starting from 0.0 pips.

- MetaTrader 4, MetaTrader 5, cTrader, and TradingView support.

- High leverage options up to 1:500.

- No dealing desk (NDD) execution for faster trades.

- Regulated by ASIC, CySEC, and FSA Seychelles.

- 24/7 customer support with live chat and email.

Cons

- Minimum deposit of $200 may not suit all traders.

- Limited educational content compared to some competitors.

- No proprietary trading platform.

- Regulatory protection depends on jurisdiction.

Tradeable Assets on IC Markets

IC Markets offers a vast range of financial instruments, featuring ultra-low spreads and deep liquidity. Whether you're trading forex, stocks, or cryptocurrencies, you'll find excellent trading conditions.

Forex

Access over 60 forex pairs with some of the lowest spreads in the industry, starting from 0.0 pips.

- EUR/USD – From 0.0 pips

- GBP/USD – From 0.2 pips

- USD/JPY – From 0.1 pips

- Exotic pairs like USD/TRY & EUR/ZAR

Indices

Trade global stock indices with tight spreads and high leverage, offering access to major markets worldwide.

- S&P 500 – From 0.3 points

- NASDAQ 100 – From 1.0 points

- FTSE 100 – From 1.0 points

- DAX 40 – From 0.9 points

Commodities

Trade both hard and soft commodities, including energy, metals, and agricultural products.

- Gold (XAU/USD) – From 0.10

- Silver (XAG/USD) – From 0.20

- Crude Oil (WTI) – From 0.02

- Natural Gas – From 0.01

Stocks

Access global stocks from the US, Europe, and Asia with tight spreads and leverage up to 1:20.

- Apple (AAPL) – Commission $3 per lot

- Amazon (AMZN) – Commission $3 per lot

- Tesla (TSLA) – Commission $3 per lot

- Alibaba (BABA) – Commission $3 per lot

Cryptocurrencies

Trade leading cryptocurrencies with leverage up to 1:5 and no need for a crypto wallet.

- Bitcoin (BTC/USD) – From $15

- Ethereum (ETH/USD) – From $3

- Ripple (XRP/USD) – From $0.0004

- Litecoin (LTC/USD) – From $0.50

IC Markets Spreads & Commissions

IC Markets is well known for its ultra-low spreads, making it an attractive choice for traders. Since trading costs impact profitability, it's important to understand how much you will actually pay. Below, you’ll find a breakdown of spread types and commission charges.

| Account Type | Spreads | Commission (per lot) |

|---|---|---|

| Standard Account | From 1.0 pips | No Commission |

| Raw Spread Account | From 0.0 pips | $3.50 per lot (per side) |

| cTrader Account | From 0.0 pips | $3.00 per lot (per side) |

Spreads may vary depending on market conditions. So, checking real-time spreads is always a good idea. If you want to see the latest updates and a deeper breakdown, visit our full guide: IC Markets Spreads & Commissions.

Open an IC Markets AccountIC Markets Minimum Deposit & Account Types

IC Markets requires a minimum deposit of $200 to open an account. Since different traders have unique needs, the broker offers three main account types. Each account is designed for a specific trading style, so let’s compare their features to help you choose the best one.

| Account Type | Minimum Deposit | Spreads | Commission | Best For |

|---|---|---|---|---|

| Standard Account | $200 | From 1.0 pips | No Commission | Casual traders & beginners |

| Raw Spread Account | $200 | From 0.0 pips | $3.50 per lot | Scalpers & high-frequency traders |

| cTrader Account | $200 | From 0.0 pips | $3.00 per lot | Algo traders using cTrader |

Because choosing the right account is essential, understanding the differences will help you make a better decision. To learn more about deposit requirements and account features, read our full guide: IC Markets Minimum Deposit.

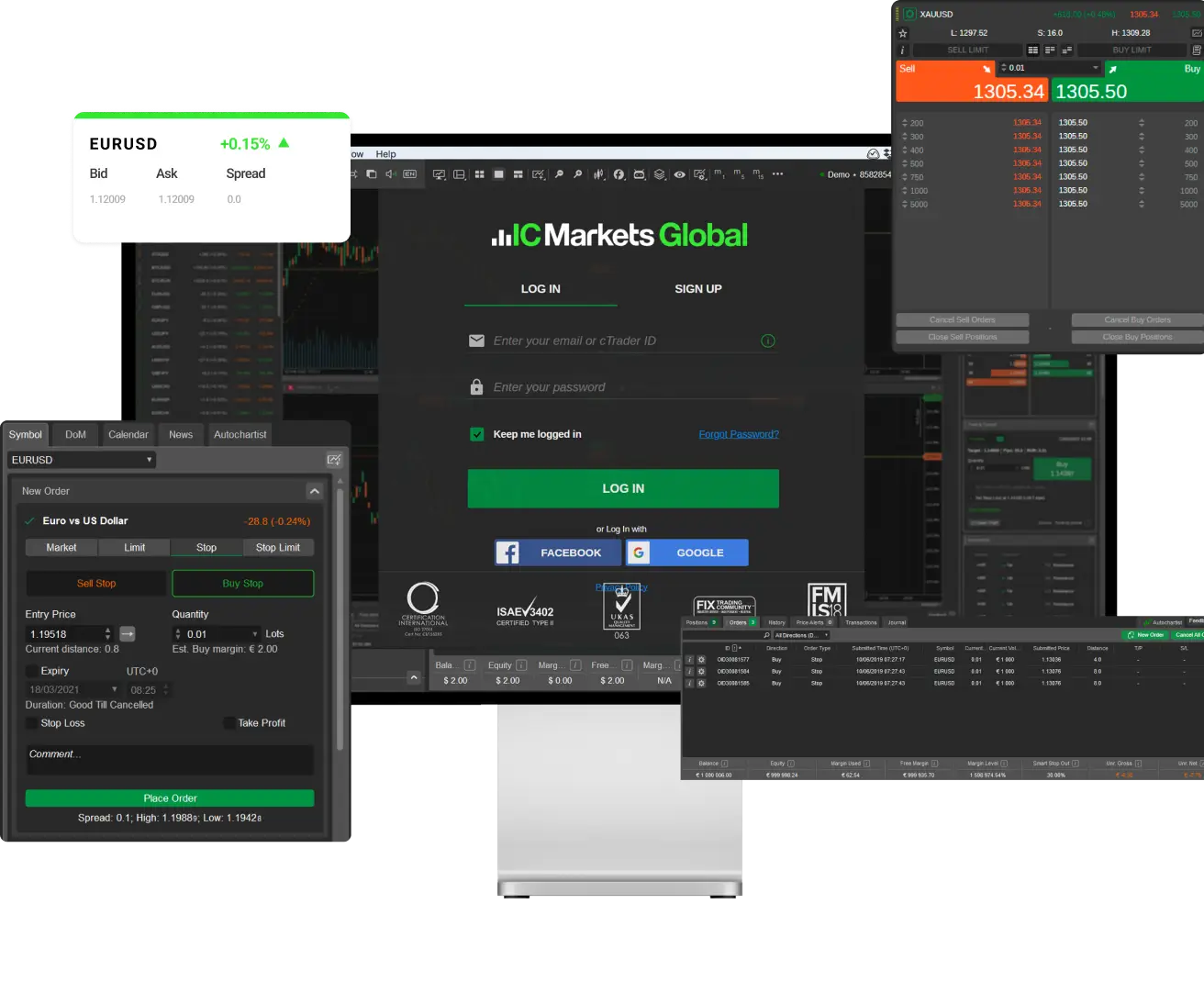

Open an IC Markets AccountTrading Platforms: TradingView, MetaTrader & cTrader

IC Markets offers multiple trading platforms, catering to different types of traders. Whether you prefer chart-heavy analysis, algorithmic trading, or fast execution, there’s an option for you.

TradingView

Perfect for advanced charting and technical analysis, TradingView allows traders to execute trades directly from their charts.

Best TradingView Brokers

MetaTrader 4 & 5

The most popular platform worldwide, MetaTrader offers automated trading, custom indicators, and extensive backtesting capabilities.

Best MetaTrader Brokers

cTrader

Designed for professional traders, cTrader provides deep market access, advanced order types, and algorithmic trading tools.

More on cTraderLeverage at IC Markets

IC Markets offers leverage up to 1:500 for international traders. However, the available leverage depends on your region due to regulatory requirements. Since higher leverage increases position sizes, it also amplifies risk. Therefore, understanding leverage is crucial before making trading decisions.

- Forex: Up to 1:500

- Indices & Commodities: Up to 1:200

- Stocks & Cryptos: Up to 1:5

Risk Management Tools

Since leverage can increase both profits and losses, effective risk management is essential. To help traders control risk, IC Markets provides several tools. These features aim to prevent excessive losses and protect trading capital.

- Stop-Loss & Take-Profit Orders

- Negative Balance Protection (for certain regions)

- Margin Call Alerts

- Risk Calculators & Position Sizing

IC Markets Demo Account: Test Before You Trade

Before risking real money, traders can test strategies and explore the platform using a risk-free IC Markets demo account. Since market conditions can be unpredictable, practicing in a demo environment helps build confidence. Let’s take a look at what makes this demo account useful.

Unlimited Access

The IC Markets demo account has no time restrictions. Therefore, traders can practice for as long as needed without feeling rushed.

Real Market Conditions

Because prices, spreads, and execution speeds match live trading, the demo account provides a realistic experience.

Multiple Platforms

Traders can test MetaTrader 4, MetaTrader 5, and cTrader using virtual funds. As a result, they can determine which platform suits their trading style best.

Is IC Markets Good for Beginners?

Selecting the right broker is crucial for new traders. Since trading comes with risks, it’s important to choose a platform that provides the right tools and support. IC Markets offers advantages, but there are also a few drawbacks that beginners should consider.

Low Spreads

IC Markets provides tight spreads, which means new traders can reduce costs and manage their risk more effectively.

Demo Account

Because IC Markets offers a risk-free demo account, beginners can practice trading strategies before switching to live trading.

Easy-to-Use Platforms

Since MetaTrader 4, MetaTrader 5, and cTrader have user-friendly interfaces, they are great options for new traders.

Limited Educational Resources

IC Markets does not provide extensive educational content. Therefore, beginners may need to find learning materials elsewhere.

IC Markets Regulation & Security

When selecting a broker, security and regulation are crucial. Therefore, IC Markets is regulated by multiple authorities, ensuring both transparency and trader protection.

Regulatory Bodies

IC Markets operates under strict financial regulations across several jurisdictions. As a result, traders benefit from oversight by respected financial authorities.

- ASIC (Australia) – AFSL License No. 335692

- CySEC (Cyprus) – License No. 362/18

- FSA (Seychelles) – License No. SD018

Client Fund Protection

To further enhance security, IC Markets follows strict financial protocols. Moreover, client funds are safeguarded under multiple protective measures.

- Segregated client funds in Tier-1 banks, ensuring funds remain separate

- Negative balance protection applies in certain jurisdictions, preventing excessive losses

- Regular third-party audits are conducted, which guarantees financial transparency

Risk Considerations

Although IC Markets complies with regulatory guidelines, traders should always assess the risks involved. For instance, high leverage can be beneficial but also increases potential losses.

- High leverage can amplify both gains and losses, so risk management is essential

- Regulatory protection varies by country, meaning traders should verify their jurisdiction’s rules

- No FSCS protection for UK traders, which is an important factor to consider

Deposit & Withdrawal Methods at IC Markets

When funding a trading account, traders want a hassle-free experience. Fortunately, IC Markets offers multiple funding options, making deposits and withdrawals seamless. Moreover, deposits are usually instant, while withdrawal times may vary depending on the payment method.

Deposit Methods

Traders can deposit funds using a variety of options. In most cases, deposits are processed instantly.

- Credit/Debit Cards – Instant, allowing quick access to funds

- Bank Wire Transfer – Takes 1-3 business days, but suitable for larger deposits

- eWallets (PayPal, Skrill, Neteller) – Instant, ensuring fast transactions

- Cryptocurrencies – Processing time varies, depending on network congestion

Withdrawal Processing

IC Markets processes most withdrawals within 24 hours. However, actual times may depend on the payment provider.

- eWallets – Same-day processing, which is ideal for fast withdrawals

- Credit/Debit Cards – Typically 2-3 business days, making it a reliable option

- Bank Transfers – Usually take 2-5 business days, but work well for larger amounts

Fees & Restrictions

IC Markets does not charge internal deposit or withdrawal fees. Nevertheless, traders should be aware that third-party fees may apply, depending on their bank or payment provider.

Customer Support: How Good is IC Markets' Assistance?

Reliable customer support is essential for traders. IC Markets provides multiple support channels, ensuring quick and effective assistance whenever needed.

24/7 Live Chat & Email Support

IC Markets offers 24/7 customer support via live chat and email. Response times are generally fast, with most queries resolved within minutes.

Phone Support for Urgent Issues

Traders can also contact IC Markets via phone. However, phone support is only available during business hours.

Comprehensive Help Center

IC Markets provides a detailed help center with FAQs and troubleshooting guides, making it easier for traders to find answers independently.

IC Markets vs Other Brokers

How does IC Markets compare to other top brokers? Below is a side-by-side comparison of key features.

| Feature | IC Markets | eToro | Pepperstone |

|---|---|---|---|

| Regulation | ASIC, CySEC, FSA | FCA, CySEC, ASIC | ASIC, FCA, DFSA |

| Trading Platforms | MetaTrader 4/5, cTrader, TradingView | Proprietary, MetaTrader | MetaTrader 4/5, cTrader |

| Minimum Deposit | $200 | $50 | $200 |

| Spreads | From 0.0 pips | From 1.0 pips | From 0.0 pips |

| Commission | $3.50 per lot | No commission (spread only) | $3.50 per lot |

| Leverage | Up to 1:500 | Up to 1:30 | Up to 1:500 |

| Read Review | Read eToro Review | Read Pepperstone Review |

Final Thoughts: Should You Trade with IC Markets?

IC Markets is an excellent choice for traders looking for low spreads, fast execution, and multiple trading platforms. However, it may not be ideal for beginners who need extensive educational content. Below is a quick recap of the pros and cons.

Pros

- Ultra-low spreads from 0.0 pips

- MetaTrader, cTrader, and TradingView support

- High leverage options up to 1:500

- No dealing desk intervention

- 24/7 customer support

Cons

- Minimum deposit of $200

- Limited educational resources

- No proprietary trading platform

- Regulatory restrictions in some countries