FXCM Review 2025: Your Guide to Advanced Trading and Low Spreads

Explore FXCM’s competitive pricing, advanced platforms, and diverse trading instruments designed for all experience levels.

Introduction

FXCM, established in 1999, is a globally recognized broker specializing in forex and CFD trading. With a strong regulatory framework and a commitment to providing user-friendly platforms, FXCM caters to both novice and experienced traders. The broker offers a variety of trading instruments, including forex, indices, commodities, and cryptocurrencies.

Key Features

- Minimum Deposit: $50

- Tradable Assets: Forex, Indices, Commodities, Cryptocurrencies, Shares

- Tier 1 Regulation: FCA, ASIC, FSCA, ACPR, BaFin, CONSOB

- Trading Platforms: MetaTrader 4 (MT4), Trading Station, NinjaTrader, TradingView

- Maximum Leverage: Up to 1:400

- Main Features: Access to multiple trading platforms, advanced charting tools, support for algorithmic trading, mobile trading apps, comprehensive educational resources

Pros and Cons of FXCM

- Regulated by Top-Tier Authorities: FXCM is authorized by reputable regulators ensuring a secure trading environment

- User-Friendly Platforms: Offers platforms like MetaTrader 4 (MT4), Trading Station, and TradingView integration, catering to various trading preferences.

- Competitive Spreads: Provides tight spreads, with EUR/USD spreads starting from 0.7 pips.

- Educational Resources: FXCM offers high-quality educational content, including webinars and tutorials, beneficial for traders at all levels.

- Limited Product Portfolio: Focuses primarily on CFDs; lacks offerings in real stocks or ETFs.

- High Bank Withdrawal Fees: Bank withdrawals can incur fees up to $40, which is higher compared to some competitors.

- Inactivity Fee: Charges a $50 fee after one year of inactivity.

FXCM Fees Overview

FXCM maintains a transparent fee structure:

Forex Trading: Spreads are built into the pricing, with no separate commission. For example, the EUR/USD spread is 0.7 pips.

Index CFD Trading: Spreads are competitive; for instance, the spread for S&P 500 index CFDs is 0.4 points.

Stock CFD Trading: Spreads for stock CFDs are built into the pricing; for example, the spread for Apple stock CFDs is $1.0.

Non-Trading Fees: No account maintenance or deposit fees. However, inactivity fees of $50 apply after one year of no trading activity, and bank withdrawals can cost $40.

Disclaimer: Fees are accurate as of January 2025 and are subject to change. Please visit FXCM’s official website for the latest updates.

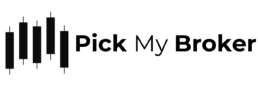

A Closer Look at FXCM's Trading Platform

FXCM provides a range of platforms to suit different trading styles:

MetaTrader 4 (MT4): A widely used platform known for its advanced charting tools and automated trading capabilities.

Trading Station: FXCM’s proprietary platform offering robust analytical tools and a customizable interface.

TradingView Integration: Allows traders to utilize advanced charting and social networking features directly through TradingView.

Mobile Trading: FXCM offers mobile versions of its platforms, enabling traders to manage their accounts on the go.

Discover FXCM’s Trading Platform Today!

Assets You Can Trade on FXCM

Forex

Spreads starting from 0.7 pips on major pairs.

Leverage up to 1:30 for retail clients.

24-hour trading, five days a week.

Indices

Spreads from 0.4 points on the S&P 500 index.

Leverage up to 1:20 for retail clients.

No commission fees on index trades.

Crypto

Available 24/7 with high liquidity.

Leverage up to 1:2 for retail clients.

No need for a digital wallet; trade directly through the platform.

Commodities

Competitive spreads; for example, gold spreads from 0.5 points.

Leverage up to 1:10 for retail clients.

Diverse commodity markets for portfolio diversification.

Is FXCM Safe to Use?

FCA (UK)

Provides oversight for UK-based clients.

ASIC (Australia)

Regulates operations for Australian traders.

FSCA (South Africa)

Oversees activities in South Africa.

How Does FXCM Handle Customer Support?

FXCM offers 24/5 customer support through various channels:

Live Chat: Instant assistance via their website.

Email Support: Responsive support for detailed inquiries.

Phone Support: Dedicated lines for immediate help.

Additionally, they provide a comprehensive FAQ section and educational resources to assist traders at all levels.

Start Trading with FXCM Today!

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.