eToro Review 2025: Your Guide to the World’s Leading Social Trading Broker

Explore eToro’s features, fees, and safety to make an informed choice.

Introduction

eToro is a globally recognized broker, known for its user-friendly platform and groundbreaking social trading features. Millions of investors worldwide trust eToro for its wide range of assets, including stocks, forex, and cryptocurrencies. In this review, we’ll dive into eToro’s fees, trading platform, safety features, and more to help you decide if it’s the right choice for you.

Key Features

- Minimum Deposit: $10 (Varies by region)

- Tradable Assets: Stocks, ETFs, Forex, Commodities, Indices, Cryptocurrencies

- Tier 1 Regulation: FCA, ASIC, CySECA

- Trading Platforms: eToro Web Platform, eToro Mobile App

- Maximum Leverage: Up to 1:30 (Retail), Up to 1:400 (Professional)

- Main Features: Social & copy trading, commission-free stock trading, user-friendly interface, wide asset selection

Pros and Cons of eToro

- Beginner-friendly platform.

- Commission-free stock trading.

- Wide range of assets.

- Social trading features.

- Regulated by top-tier authorities.

- Limited customer service options.

- High forex fees.

- Cryptocurrency withdrawals restricted to eToro Wallet.

eToro Fees Overview

- Stock Trading: Commission-free for US stocks.

- Forex Spreads: Starting from 1 pip for EUR/USD and 1.5 pips for GBP/USD.

- Cryptocurrency Fees: 1% spread for opening and closing trades.

- Withdrawal Fee: $5 per withdrawal.

- Inactivity Fee: $10 per month after 12 months of inactivity.

- CFD Fees: Competitive spreads starting at 0.09% for stock CFDs.

Disclaimer: Fees are accurate as of January 2025 and are subject to change. Please visit eToro’s official website for the latest updates.

A Closer Look at eToro’s Trading Platform

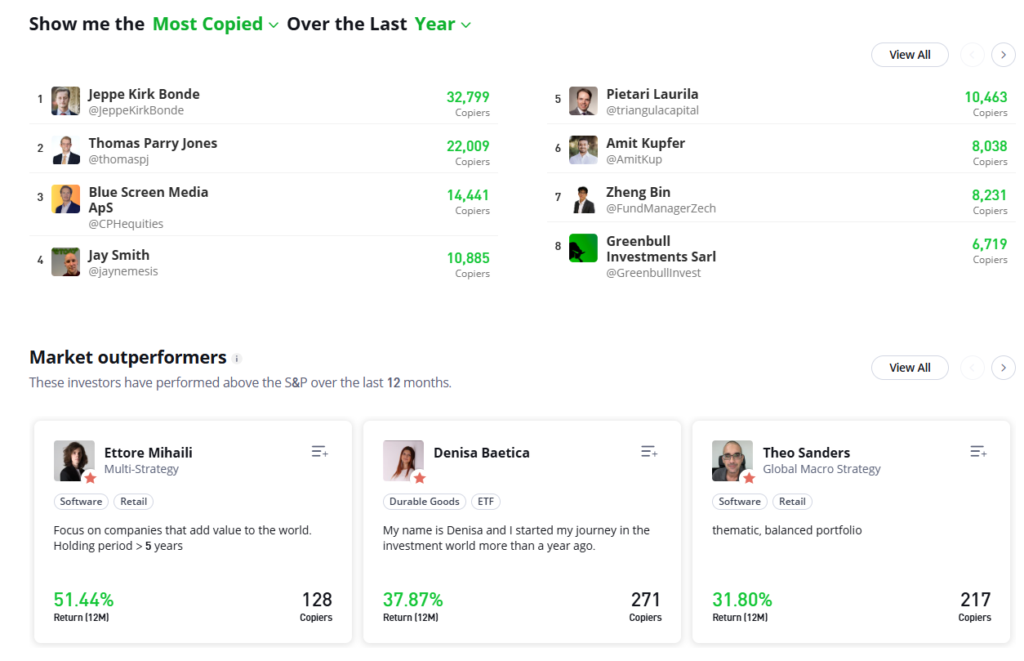

eToro’s trading platform is designed with both beginners and experienced traders in mind. Its key features include:

- Web-Based Platform: No need to download software, accessible on any device.

- Mobile App: A seamless trading experience on the go, available for iOS and Android.

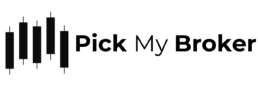

- Social Trading: Copy the strategies of top-performing investors using the innovative CopyTrader feature.

- Charting Tools: Advanced tools with technical indicators and customizable charts for in-depth analysis.

- User-Friendly Interface: Intuitive design ensures easy navigation for traders of all skill levels.

Discover eToro’s Trading Platform Today!

Assets You Can Trade on eToro

Forex

EUR/USD: Starting from 1 pip.

GBP/USD: Starting from 1.5 pips.

USD/JPY: Starting from 1 pip.

AUD/USD: Starting from 1 pip.

Stocks

- Zero commissions on major stocks like those on NYSE and NASDAQ.

- Invest with as little as $10 in top stocks like Tesla.

- Access stocks from the US, UK, Europe, and more.

- Earn dividends even with fractional shares.

Crypto

- Trade Bitcoin, Ethereum, and more with spreads from 1%.

- Invest in crypto starting at $10.

- Enjoy 24/7 trading with no hidden fees.

- Store securely in the eToro Money wallet.

Commodities

- Trade popular commodities like gold, silver, and oil.

- Access competitive spreads starting from 0.45% on gold.

- Diversify your portfolio with both hard and soft commodities.

- Invest with leverage options to maximize potential returns.

ETFs

- Trade a wide range of ETFs across global markets.

- Invest with zero commission on ETF trades.

- Diversify your portfolio with sector-specific and index ETFs.

- Start investing with as little as $10 using fractional shares.

Indices

- Trade major indices like the S&P 500, NASDAQ, and FTSE 100.

- Access competitive spreads starting from 0.75%.

- Diversify with global index options covering the US, Europe, and Asia.

- Invest with leverage to maximize your trading potential.

Is eToro Safe to Use?

FCA (UK)

eToro is regulated by the Financial Conduct Authority (FCA) in the United Kingdom, ensuring compliance with top-tier investor protection standards.

CySEC (EU)

In Europe, eToro is governed by the Cyprus Securities and Exchange Commission (CySEC), providing oversight to ensure transparency and adherence to EU regulations.

ASIC (Australia)

Australian users benefit from eToro’s regulation by the Australian Securities and Investments Commission (ASIC), which enforces robust financial protections.

How Does eToro Handle Customer Support?

Start Trading with eToro Today!

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.