IG Review 2025: Your Guide to Cutting-Edge Platforms and Global Market Access

Discover IG’s platforms, fees, and regulation to make an informed trading decision.

Introduction

IG is a well-established online broker, renowned for its user-friendly trading platforms, extensive educational resources, and a wide range of tradable instruments. With a global presence and regulation by top-tier authorities, IG caters to both novice and experienced traders. In this review, we’ll delve into IG’s key features, fees, regulatory standing, and more to help you determine if it’s the right broker for your trading needs.

Key Features

- Minimum Deposit: $0 (No minimum deposit required)

- Tradable Assets: Forex, Indices, Commodities, Stocks, ETFs, Options, Cryptocurrencies, Bonds

- Tier 1 Regulation: FCA, ASIC, CFTC, NFA, BaFin, FINMA, MAS

- Trading Platforms: IG Web Platform, MetaTrader 4, L2 Dealer, ProRealTime, TradingView

- Maximum Leverage: Up to 1:200 (varies by region and regulation)

- Main Features: Over 17,000 markets, extensive educational resources, guaranteed stop-loss orders, tight spreads

Pros and Cons of IG

- User-Friendly Platforms: IG offers intuitive and well-designed trading platforms suitable for traders of all levels.

- Extensive Educational Resources: A wealth of educational tools and materials to support trader development.

- Diverse Range of Markets: Access to over 17,000 markets, including forex, indices, commodities, and more.

- Strong Regulatory Oversight: Regulated by multiple top-tier financial authorities, ensuring a secure trading environment.

- High Fees for Stock CFDs: Trading fees for stock CFDs are relatively high compared to other instruments.

- Limited Product Portfolio in Some Regions: In certain countries, IG primarily offers CFD and options trading, limiting access to other asset classes.

- Customer Support Limitations: Customer support can be slow during peak times, potentially affecting timely assistance.

IG Fees Overview

IG’s fee structure varies across different instruments:

- Forex Trading: Competitive spreads, with major pairs like EUR/USD starting from 0.6 pips.

- Stock CFDs: Higher fees, with commissions varying by market (e.g., $0.02 per share for US stocks).

- Indices: Spreads starting from 1 point on major indices like the FTSE 100.

- Commodities: Competitive spreads, e.g., 0.3 points on gold.

- Non-Trading Fees: No deposit or withdrawal fees; however, an inactivity fee of $12 per month applies after two years of inactivity.

Disclaimer: Fees are accurate as of January 2025 and are subject to change. Please visit IG’s official website for the latest updates.

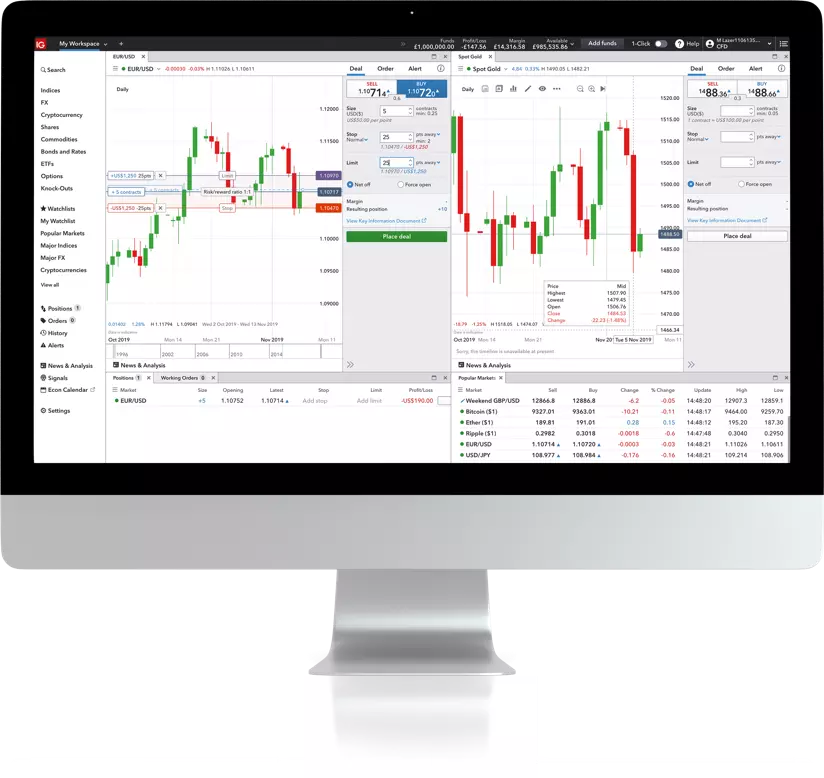

A Closer Look at IG'sTrading Platform

IG provides a suite of trading platforms to accommodate various trading styles:

- IG Web Platform: A user-friendly, customizable platform accessible via web browsers.

- MetaTrader 4 (MT4): Supports automated trading with Expert Advisors and advanced charting tools.

- ProRealTime: Advanced charting software for technical analysis enthusiasts.

- L2 Dealer: For direct market access (DMA) trading, suitable for advanced traders.

- Mobile Trading App: Available for iOS and Android, allowing trading on the go with full account functionality.

Discover IG’s Trading Platform Today!

Assets You Can Trade on IG

Forex

EUR/USD: Spreads starting from 0.6 pips.

GBP/USD: Spreads starting from 0.9 pips.

AUD/USD: Spreads starting from 0.6 pips.

USD/JPY: Spreads starting from 0.7 pips.

Stocks

Apple (AAPL): Commission starting at $0.02 per share.

Amazon (AMZN): Commission starting at $0.03 per share.

Tesla (TSLA): Commission starting at $0.02 per share.

Google (GOOGL): Commission starting at $0.03 per share.

Crypto

Bitcoin (BTC/USD): Spreads starting from 0.4%.

Ethereum (ETH/USD): Spreads starting from 1.2%.

Litecoin (LTC/USD): Spreads starting from 1.5%.

Ripple (XRP/USD): Spreads starting from 0.6%.

Commodities

Gold (XAU/USD): Spreads starting from 0.3 points.

Silver (XAG/USD): Spreads starting from 2.5 points.

Crude Oil (WTI): Spreads starting from 0.4 points.

Natural Gas: Spreads starting from 0.3 points.

ETFs

ETFs

SPDR S&P 500 ETF (SPY): Spreads starting from 0.03%.

Invesco QQQ Trust (QQQ): Spreads starting from 0.04%.

Vanguard Total Stock Market ETF (VTI): Spreads starting from 0.02%.

Indices

S&P 500 (US500): Spreads from 0.4 points.

NASDAQ 100 (US100): Spreads from 0.6 points.

FTSE 100 (UK100): Spreads from 1 point.

DAX 40 (GER40): Spreads from 1 point.

IG is regulated by several top-tier financial authorities, ensuring a secure trading environment:

FCA (UK)

The Financial Conduct Authority regulates IG in the United Kingdom, ensuring strict adherence to financial and investor protection standards.

CFTC & NFA (USA)

IG is regulated by the Commodity Futures Trading Commission and National Futures Association, ensuring compliance with US trading regulations.

ASIC (Australia)

The Australian Securities and Investments Commission provides oversight for IG’s operations in Australia, maintaining high regulatory standards.

MAS (Singapore)

The Monetary Authority of Singapore oversees IG in Singapore, upholding stringent financial regulations.

FSA (Japan)

IG is licensed by the Financial Services Authority in Japan, offering secure trading options to Japanese clients.

FSCA (South Africa)

The Financial Sector Conduct Authority ensures regulatory compliance for IG’s operations in South Africa.

DFSA (UAE)

Regulated by the Dubai Financial Services Authority, IG adheres to financial laws in the United Arab Emirates.

BMA (Bermuda)

The Bermuda Monetary Authority regulates IG’s global operations outside other jurisdictions.

How Does IG Handle Customer Support?

IG offers multiple channels for customer support:

- Live Chat: Available during trading hours for real-time assistance.

- Email Support: For detailed inquiries, with responses typically within 24 hours.

- Phone Support: 24-hour support from 8 am Saturday to 10 pm Friday.

- Comprehensive Help Center: Includes FAQs, guides, and educational resources.

Start Trading with IG Today!

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.